US trade deficit soars to new high of US$61.04 billion

Tuesday, April 12, 2005

The U.S. Commerce Department released new figures on Tuesday, showing an imbalance of US$61.04 billion as of February. The figure was up 4.3 percent from the US$58.5 billion deficit last January.

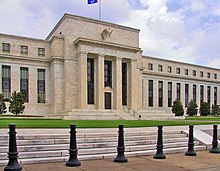

"While we imported the necessities, we didn't sell a lot to the rest of the world," Joel Naroff, president of Naroff Economic Advisors told Bloomberg. "As for the Fed, this report would likely mean more measured rate hikes," he said.

"We are sucking in more products faster than we can sell abroad. It will reduce GDP growth a bit, but not a lot," David Berson, the chief economist for Fannie Mae told Reuters.

The trade deficit has been aggravated by high oil prices and a surge of textile imports after the lifting of quotas on January 1. Oil prices have been close to record levels recently, but light sweet crude fell $1.85 to US$51.86 on Tuesday, after the International Energy Agency issued a prediction that interest rates and fuel costs would slow down demand for oil.

The new trade figures temporarily forced the dollar down against the yen and the euro. But later in the trading day, the dollar recovered lost ground as traders waited for a statement about the U.S. Federal Reserve meeting last March.

Sources

edit- Martin Crutsinger, AP. "U.S. trade deficit hits $61.04B in Feb." — BusinessWeek, April 12, 2005

- Doug Palmer. "Trade Gap Widens to Record $61 Billion" — Reuters, April 12, 2005

- "U.S. Trade Deficit Widened to Record $61 Bln in Feb. (Update9)" — Bloomberg, April 12, 2005