New Zealand raises interest rates in second straight month to 0.75%

Correction — May 10, 2023

The article as originally published referred to Auckland as the capital. It is not, it is the largest city. Wellington City is the capital. The article below has been corrected for this mistake.

Thursday, November 25, 2021

Image: Kaihsu Tai.

The Reserve Bank of New Zealand (RBNZ) raised interest rates by 25 basis points to 0.75% during its last policy meeting of the year yesterday, after the rate of consumer price inflation was recorded at 4.9% in the third quarter, the highest since December 2007.

The hike to the national official cash rate (OCR) was widely expected by economists and the markets alike: 21 of the 23 economists surveyed in a November 15-19 Reuters poll predicted an increase of 25 basis points, while the other two projected an increase by 50 basis points, to 1%.

New Zealand's handling of COVID-19 included injecting "huge amounts of fiscal and monetary stimulus" into the economy, according to The Guardian, in line with other major economies, which has pushed the unemployment rate to the lowest and inflation to its highest in over a decade. Stimulus spending and low interest rates, along with a shortage in housing led home prices to double in the last seven years, the least affordable of the OECD nations, according to Reuters.

A statement from the Reserve Bank said the "near-term rise in inflation [accentuated] by higher oil prices, rising transport costs and the impact of supply shortfalls" are risking "generating more generalised price rises", as reported by ABC News. The RBNZ forecasts rates would rise to 2.5% by 2023, and still higher by 2024, according to Reuters; however, medians from a Friday article predicted the OCR would reach only 2% by year-end 2023, below what it was in 2014.

More recent projections include to 2% by mid-2022 according to economist at Capital Economics Ben Udy, to a high of 3% by Q3 2023 according to acting chief economist at Westpac Michael Gordon, including a 0.5% rate hike during the RBNZ's next meeting in February, as reported by The Guardian.

Yesterday's announcement came after a widely-expected rate hike from 0.25% to 0.5% on October 6, the first in seven years, as part of the RBNZ's tightening cycle initially slated to begin August but pushed back due to the Delta variant of COVID-19 and lockdown in the largest city Auckland. Senior market strategist at the Bank of New Zealand Jason Wong told Reuters then: "We're on a path towards a series of rate hikes and the market is well priced for that."

RBNZ Governor Adrian Orr told reporters yesterday "we see steady steps of 25 basis points back to levels where the OCR is marginally above the neutral rate as the most balanced approach we can take", though Reuters reports the bank had considered a range of options, including a 50 basis point hike.

Orr added on housing, "Homeowners who have just entered the market with extremely high leverage levels have to be incredibly wary and have to understand they have to weather the higher interest rates", after earlier taxes levied on property investors failed to cool rising house prices, which Reuters reports the RBNZ believes are above their sustainable level, and at increased chance for a correction. He also defended the stimulus but noted the growth in household debt ensuing.

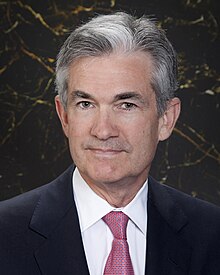

Image: Federal Reserve.

While countries globally are winding down pandemic-related stimulus measures, according to Reuters, there has been pushback from some countries when it comes to raising interest rates: in the United States, the inflation rate recently rose to 6.2%, the highest in 31 years, which has led some economists to put pressure on Federal Reserve chair Jerome Powell to accelerate the process of tapering its monthly bond purchases, according to the Associated Press. The Bank of England and European Central Bank (ECB) also both withstood criticism for a forecasted rise in inflationary pressures, according to The Guardian and Reuters.

ECB President Christine Lagarde told the European Parliament on November 15 "an undue tightening of financing conditions is not desirable, and would represent an unwarranted headwind for the recovery", adding "[i]f we were to take any tightening measures now, it could cause far more harm than it would do any good", as reported by Reuters.

Australia's Reserve Bank of Australia (RBA) maintained its position that interest rates are not likely to rise until 2024. RBA Governor Philip Lowe told an Australian Businesses Economists lunch last week "the latest data and forecasts do not warrant an increase in the cash rate in 2022", and for one to be considered by the board "[t]he economy and inflation would have to turn out very differently from our central scenario", according to ABC News.

However, several central banks have increased rates ahead of even New Zealand: Reuters names Norway, the Czech Republic and South Korea, which is expected to raise rates again in a meeting today.

Reuters reports the New Zealand dollar fell 0.6% due to some investors predicting a higher hike, and both 2- and 10-year government bonds slipped by 10 basis points each.

Sister links

Sources

- Martin Farrer. "New Zealand interest rate hike raises pressure on central banks over inflation" — The Guardian, November 24, 2021

- Praveen Menon, Tom Westbrook. "New Zealand hikes rates again, warns homeowners to get ready for more" — Reuters, November 24, 2021

- Nassim Khadem. "The Reserve Bank of New Zealand hikes interest rates again but the RBA may not follow for some time" — ABC News (Australia), November 24, 2021

- Vivek Mishra, Devayani Sathyan. "New Zealand c.bank on a hiking spree as economic climate gets hotter" — Reuters, November 21, 2021

- Christopher Rugaber. "Pressure on Fed’s Powell is rising as inflation worsens" — Associated Press, November 18, 2021

- Richard Partington. "Bank of England under pressure to increase interest rates after inflation rise" — The Guardian, November 17, 2021

- Balazs Koranyl, Francesco Canepa, Tom Sims, Frank Siebelt. "ECB's Lagarde keeps pushing back on rate hike bets and hopes" — Reuters, November 15, 2021

- Praveen Menon, Tom Westbrook. "New Zealand raises rates for first time in seven years, more to come" — Reuters, October 6, 2021